If you are a paypal user from India, I am sure must have got the email from paypal now stating that from March 1st,

- You can’t receive payments more than $500 per transaction.

- You can’t use your paypal balance to buy anything online.

- You must transfer any payment you receive in your paypal account to your bank account within 7 days of receipt.

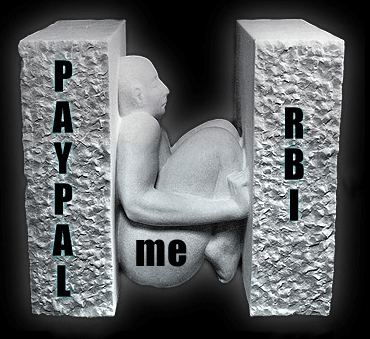

Paypal said that they are forced to do this because of RBI restrictions. Bloggers are bashing RBI for this move, and some have gone as far as to saying that with this move of RBI paypal is dead now. Others have started a campaign to send signed petition to RBI from Indian entrepreneurs.

I am a business owner myself and I run an online branding consultancy. If someone should be worried by this move, then it would be me.

But we should think clearly here. Before playing the blame game, lets get our facts straight, let’s find out who is the culprit here.

RBI has to keep a strict eye on all inflow/outflow of money from India, to prevent money laundering, terrorist funding etc. Also, it has laid some guidelines to regulate banks to help us, consumers.

Paypal, however, is a business. And like any other business, it has only one goal, maximize revenue. If they come under RBI regulations, how will they charge exorbitant fees from us while receiving money, sending money or while converting currency. They say on their official blog that,

In order to comply with the RBI guidelines, our user agreement in India will be amended.

But the reality is different. As the cliched saying goes, sometimes, things are not as they appear.

You must withdraw money from paypal within 7 days because if it keeps your money for more then 7 days, then according to RBI guidelines, it must pay you Interest on that money. Interest? Are you kidding me? Paypal will never ever pay interest, and will never want to get its fees regulated. So what did they do, they forced us to withdraw money immediately. Not to comply with RBI guidelines, but to evade them.

Why you can’t receive more then $500 per transaction? Because, again, according to RBI guidelines, any financial entity must report all the transactions above $500 to RBI and Government of India. But if they force us, end users, to make sure that the transactions are less than $500, they don’t have to show anything to RBI. Again, compliance or elusion? You can decide.

Why you can’t buy any product or service online using your paypal balance? This is because since paypal is leaving no stone unturned to escape the RBI umbrella, RBI and Government of India has no means to check what did you spent/earned online and so they can’t put taxes on that. Thus they forced paypal to comply, but paypal, being the veteran of this game, knows how to deal with that. Just kick the end users, where will they go? This is how a monopoly works.

In short, paypal does not want to be regulated by RBI under any circumstance. They don’t want to answer anyone how they do business, and why should they? They are free to do whatever they like, after all, what alternative do the Indian paypal users have? Thus the restrictions by paypal.

So who is the culprit here? Paypal or RBI? The facts are before you, you decide.

I rest my case.

It is very sad. Now in between them what customer do? We are like a ball every one want to play him…

What will happen if I leave my paypal balance for more than 7 days? Also tell what is the minimum amount I can tranfer to my indian bank account?

With this RBI-Paypal fiasco .. I am wondering will Google Check-out and amazon check-out will prove to be better alternatives to Paypal. Google Check-out for one is certainly cheaper … nd doesn’t lock merchant accounts on its whims like Paypal does. Another question are you trying to say that its just Paypal which is trying to evade RBI guidelines while these alternatives – Google Checkout and Amazon Checkout adhere to them entirely ?

@Shailendra Dhanuk

Its not clear what will happen if you keep the balance for more then 7 days. May be paypal will return it to sender. But we should wait for paypal’s official response on this.

There is no ‘minimum amount’. You can transfer any amount you want. Its just that fee will be different for different amounts.

@Saurabh

Google checkout and Amazon checkout does have better customer service then paypal. But I am not sure if they follow RBI guidelines.

Yes, I am saying that payapl is trying hard not to come under RBI umbrella. This is good for their business, but unfortunately, not good for paypal users in India.